The Essential Accounts Payable Workflow Process Guide 2026

Master the accounts payable workflow process with this 2026 guide. Streamline AP, boost accuracy, ensure compliance, and future proof your finance operations.

Published December 1, 2025 — 15 minutes read — Fintech Guides

Written by François Savard

Manual accounts payable can be a minefield in 2026. As regulations tighten and digital transformation accelerates, even a small mistake can lead to costly delays or compliance risks.

This guide aims to demystify the accounts payable workflow process, breaking down each stage with actionable insights for finance professionals. Whether you’re in a growing business or a large enterprise, understanding these workflows is critical.

You’ll get a practical blueprint for streamlining AP, reducing costs, and keeping your operations ready for the future. Explore the essentials, step-by-step guidance, technology trends, and real-world troubleshooting tips.

Ready to master the accounts payable workflow process and drive your finance team forward? Let’s dive in.

Understanding the Accounts Payable Workflow Process

Accounts payable (AP) is central to business finance, responsible for managing and paying a company’s short-term obligations to suppliers and vendors. The accounts payable workflow process ensures that every supplier invoice is tracked, validated, and paid correctly. Unlike accounts receivable, which manages incoming payments from customers, AP focuses on outgoing funds. A well-managed AP process is crucial for maintaining healthy cash flow and fostering positive supplier relationships, which can impact credit terms and supply chain stability.

What Is Accounts Payable?

Accounts payable refers to all outstanding bills a business owes to its suppliers for goods or services received but not yet paid for. The accounts payable workflow process begins as soon as an invoice arrives and continues until payment is completed and recorded. This is distinct from functions like accounts receivable, which manages money owed to the business by clients. AP is vital not just for smooth operations, but also for optimizing cash flow and ensuring that suppliers remain reliable partners.

Core Components of the AP Workflow

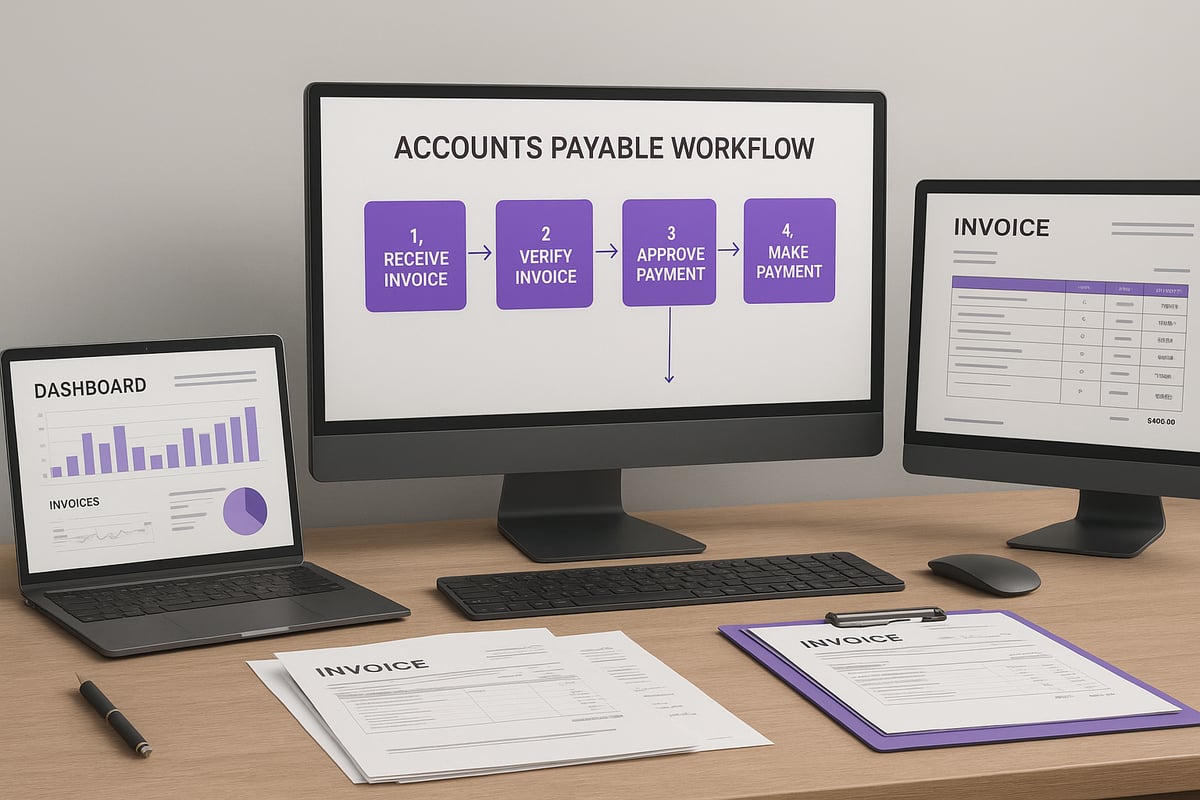

The accounts payable workflow process includes several key steps:

- Invoice receipt and capture: Collecting invoices through email, mail, EDI, or supplier portals.

- Verification and approval routing: Checking invoice details and routing for necessary approvals.

- Payment scheduling and execution: Deciding when and how to pay, then making the payment.

- Record-keeping and reconciliation: Updating systems and reconciling accounts.

Each of these steps must be managed with accuracy to prevent errors and maintain compliance.

Why Modern AP Workflow Matters in 2026

In 2026, the accounts payable workflow process is shaped by rapid automation and digital transformation. Regulatory scrutiny is rising, requiring finance teams to maintain tighter controls and more transparent audit trails. Automation tools, such as electronic accounts payable systems, not only reduce manual errors but also improve efficiency and compliance. AP is now a strategic function, enabling better decision-making through real-time data and streamlined processes.

Common AP Workflow Models

Businesses may structure their accounts payable workflow process in different ways:

- Centralized: All AP tasks handled by a dedicated team.

- Decentralized: Departments manage their own AP with oversight.

- Manual: Paper or spreadsheet-based tracking.

- Semi-automated: Some digital tools, but manual checks remain.

- Fully automated: Cloud solutions handle end-to-end workflow.

For example, a mid-sized EU company might adopt a semi-automated, centralized model to balance control and flexibility. A comparison table can help clarify:

| Model | Pros | Cons |

|---|---|---|

| Centralized | Consistency, control | Slower, less flexible |

| Decentralized | Fast, agile | Risk of inconsistency |

Key Stakeholders in the AP Process

Effective accounts payable workflow process management requires coordination between multiple roles:

- Procurement: Initiates purchases and ensures compliance with contracts.

- AP Clerks: Handle invoice entry, matching, and processing.

- Department Heads: Approve larger or out-of-policy invoices.

- CFOs: Oversee cash flow and compliance.

In practice, cross-functional approval chains are common. For instance, an invoice over a certain threshold might require sign-off from both a department head and the CFO, ensuring financial control and accountability.

Step-by-Step Guide to the Accounts Payable Workflow

A robust accounts payable workflow process is the backbone of efficient finance operations. This step-by-step guide breaks down each stage, highlighting automation, controls, and best practices for 2026. By understanding each phase, finance teams can spot gaps and make improvements that scale.

Step 1: Invoice Receipt and Data Capture

The accounts payable workflow process begins the moment an invoice arrives. Invoices enter through email, traditional mail, EDI (Electronic Data Interchange), or supplier portals. Manual entry, once common, is now being replaced by automated data extraction tools like OCR (Optical Character Recognition) and AI-driven capture.

Accurate data entry is critical. Even a small typo can ripple through the process, causing delays and compliance issues. To reduce errors and accelerate processing, many teams now automate billing processes with intelligent capture solutions.

For example, a mid-sized tech firm cut invoice entry errors by 60 percent after introducing digital capture, freeing AP staff to focus on exceptions and analysis.

Step 2: Invoice Validation and Three-Way Matching

Once captured, invoices move into the validation phase of the accounts payable workflow process. Here, the invoice is matched against its corresponding purchase order and delivery receipt—a practice known as three-way matching.

This step is crucial for detecting discrepancies, preventing overpayments, and stopping fraud. Modern cloud AP systems automate much of this matching, flagging mismatches for review. In 2026, about 30 percent of AP teams still cite matching errors as a major bottleneck, highlighting the need for continuous improvement.

Automated validation not only speeds up approvals but also strengthens internal controls, ensuring every payment is legitimate and accurate.

Step 3: Approval Routing and Authorization

After validation, the invoice enters the approval phase of the accounts payable workflow process. Customized workflows route invoices based on type, amount, or department. Role-based access ensures only authorized personnel can approve payments, while digital audit trails track every action.

Mobile approval tools are increasingly popular, especially as remote work becomes standard. Automated routing accelerates the process, reducing bottlenecks and lost invoices.

For instance, a distributed marketing agency implemented workflow automation, cutting approval times from days to mere hours and enhancing compliance for every transaction.

Step 4: Payment Scheduling and Execution

The payment phase of the accounts payable workflow process involves choosing the right payment method—ACH, SEPA, wire transfer, or check. Teams optimize cash flow by scheduling payments to capture early-payment discounts or avoid late fees.

Payment batching allows multiple invoices to be paid at once for efficiency. Automated scheduling ensures payments go out on time, even during peak periods.

A retail chain, for example, uses payment runs to process hundreds of invoices in one session, minimizing manual intervention and reducing the risk of missed deadlines.

Step 5: Recording Payments and Reconciliation

Once payments are made, the accounts payable workflow process continues with recording transactions in ERP or accounting systems. Timely and accurate recording is essential for financial statements and audit readiness.

Bank reconciliation matches payments with bank records, flagging exceptions for quick resolution. Automation can cut the month-end close cycle by up to 50 percent, freeing time for strategic analysis.

For example, a logistics firm automated reconciliation, reducing manual effort and ensuring every payment was accounted for—crucial for regulatory compliance.

Step 6: Supplier Communication and Issue Resolution

Effective supplier communication is a vital part of the accounts payable workflow process. Proactive notifications keep suppliers informed about payment status and remittance details.

When disputes or short payments arise, automated workflows route issues to the right team for quick resolution. Supplier self-service portals allow vendors to check status and submit queries, reducing the volume of inbound emails.

A manufacturing company saw supplier inquiry volume drop by 40 percent after launching automated status updates, improving relationships and saving staff time.

Step 7: Reporting, Analytics, and Continuous Improvement

The final stage in the accounts payable workflow process is measurement and optimization. Key metrics include Days Payable Outstanding (DPO), invoice cycle time, and error rates.

Dashboards provide real-time visibility, helping teams identify bottlenecks and opportunities for savings. Regular audits and feedback loops drive continuous improvement.

For instance, a global distributor used analytics to pinpoint slow approval steps, then re-engineered workflows to save days per invoice cycle.

The Role of Technology in Accounts Payable Transformation

The accounts payable workflow process has evolved dramatically, with technology acting as both a disruptor and a stabilizer. Paper invoices and manual entry are relics for most forward-thinking finance teams. Instead, digital-first solutions now set the pace, offering speed and transparency that manual processes simply cannot match.

Evolution of AP Technology

The journey from paper-based to digital AP has reshaped the accounts payable workflow process. In the early 2020s, automation was a competitive edge. By 2026, it is the norm, not the exception. Cloud platforms and mobile access have made remote invoice management routine. According to Accounts Payable Automation Trends 2025, adoption rates for AP automation are expected to surpass 80% in mid-market businesses by late 2026.

This acceleration is driven by the need for compliance, cost containment, and real-time financial visibility. Firms that resist digital transformation risk falling behind on efficiency and regulatory requirements.

Essential AP Automation Tools in 2026

Today’s accounts payable workflow process relies on a sophisticated toolkit. Optical Character Recognition (OCR) scans and extracts invoice data with impressive accuracy. Workflow automation platforms route approvals and flag exceptions instantly. Seamless integration with ERP or accounting systems ensures updates flow automatically, reducing manual intervention.

AI-powered fraud detection tools are no longer futuristic—they are essential. These systems analyze transaction patterns and alert teams to anomalies before payments are processed. Supplier portals, too, have become standard, giving vendors real-time visibility into payment status.

Benefits of AP Automation

Automating the accounts payable workflow process results in measurable improvements. Processing costs drop by up to 80%, as manual data entry and paper shuffling disappear. Accuracy soars, with far fewer duplicate payments or missed discounts.

Compliance is easier, thanks to built-in audit trails and automated recordkeeping. Real-time dashboards offer instant insight into cash flow, outstanding liabilities, and payment cycles. This visibility empowers finance leaders to make strategic decisions, not just tactical ones.

| Benefit | Manual AP | Automated AP |

|---|---|---|

| Processing Cost | High | Low |

| Error Rate | Higher | Lower |

| Compliance Risk | Elevated | Reduced |

| Visibility | Limited | Real-time |

Implementation Challenges and How to Overcome Them

Transitioning to a modern accounts payable workflow process is not without hurdles. Data migration from legacy systems can be complex, especially if vendor records are inconsistent. Integration with existing ERP platforms may require custom development or middleware.

Change management is another challenge. Staff must be trained not only on new software, but also on updated policies and controls. Security and regulatory compliance need careful attention, especially with sensitive financial data moving to the cloud.

A phased rollout often works best. Start with one business unit, refine workflows, and build internal champions who can train others.

Future Trends in AP Technology

Looking ahead, the accounts payable workflow process will be shaped by emerging tech. AI-driven predictive analytics will forecast cash flow needs and flag potential late payments before they happen. Blockchain may enable instant, tamper-proof verification of transactions, streamlining audits.

Embedded finance is on the rise, with AP platforms offering real-time payments directly from within ERP systems. Early adopters are already leveraging instant supplier payouts, reducing friction and strengthening vendor relationships.

For finance teams, staying ahead means not just adopting tools, but continually reassessing and optimizing the entire accounts payable workflow process for agility and resilience.

Best Practices for Streamlining the AP Workflow

A strong accounts payable workflow process is built on a foundation of standardized procedures, robust controls, and a culture of continuous improvement. As AP complexity grows, following best practices becomes essential for teams aiming to reduce costs, mitigate risk, and support business agility. Let us explore the most effective strategies to streamline your AP operations and future proof your financial processes.

Standardizing Processes and Policies

Standardization is the backbone of an efficient accounts payable workflow process. Clearly documented procedures, such as invoice approval matrices and exception handling protocols, minimize confusion and ensure consistency across all departments. Centralized policy documentation makes onboarding new staff easier and reduces training time.

A practical approach is to use policy templates for invoice approvals, which can be tailored to your company’s structure. This ensures every invoice follows the same path, regardless of who handles it. For more insights, see this comprehensive list of AP best practices, which emphasizes the importance of documented workflows and automation.

Regularly review and update your AP policies to reflect regulatory changes and evolving business needs. Engage stakeholders from different departments to gather feedback and foster buy in.

Optimizing Supplier Relationships

The accounts payable workflow process thrives on strong supplier relationships. Start with a thorough supplier onboarding process, capturing accurate data up front to prevent future disputes. Maintain up to date records to avoid payment delays and compliance issues.

Consider implementing early payment programs or dynamic discounting, which can improve cash flow for both parties. Use supplier scorecards to track performance metrics like invoice accuracy and response times. This data driven approach helps prioritize valuable partnerships and identify areas for improvement.

Open communication channels with suppliers, such as self service portals, can reduce inquiry volume and build trust. Regularly solicit feedback to strengthen collaboration and align expectations.

Enhancing Internal Controls and Compliance

Internal controls are critical for a secure accounts payable workflow process. Segregation of duties—ensuring no single person controls all steps—reduces the risk of fraud and error. Audit trails, both digital and manual, provide visibility into every transaction.

Establish clear approval limits and regularly test controls through internal audits. With 81 percent of organizations facing more AP fraud attempts, robust controls are non negotiable. Leverage automation to flag unusual payment activity and enforce policy adherence.

Stay informed about regulatory changes that impact AP, such as tax rules or e invoicing mandates. Document compliance measures to demonstrate readiness during audits and minimize legal risk.

Leveraging Data for Strategic Decision-Making

Data is a powerful tool for optimizing the accounts payable workflow process. Track key metrics such as days payable outstanding (DPO), invoice cycle time, and error rates. Compare your results against industry benchmarks to identify strengths and weaknesses.

Dashboards and analytics platforms provide real time visibility, enabling finance leaders to spot trends and make informed decisions. For example, analyzing payment timing data can guide supplier negotiations or support cash flow forecasting.

Create feedback loops to review AP data regularly with your team. Use insights to drive process improvements and support broader business objectives, such as cost reduction or risk management.

Training and Empowering AP Teams

The accounts payable workflow process is only as strong as the team behind it. Invest in ongoing training on new tools, regulations, and best practices. Cross train team members to build resilience and ensure coverage during peak periods or staff turnover.

Establish AP centers of excellence in larger organizations to foster knowledge sharing and innovation. Encourage a culture where staff feel empowered to suggest improvements and flag concerns.

Recognize achievements and provide clear career progression paths. A motivated, knowledgeable AP team can adapt quickly to changes and deliver consistently high performance.

Troubleshooting and Overcoming Common AP Workflow Challenges

Modern finance teams face a shifting landscape of risks and bottlenecks within the accounts payable workflow process. Whether it is exception handling, fraud, or compliance, effective troubleshooting is essential for operational resilience.

Handling Invoice Exceptions and Discrepancies

Invoice exceptions disrupt the accounts payable workflow process and can stem from missing purchase orders, duplicate submissions, or price mismatches. These issues slow down approvals and increase manual work.

Common root causes include:

- Missing or invalid POs

- Duplicate or previously paid invoices

- Pricing or quantity discrepancies

Automated exception routing tools, supported by supplier education, can streamline resolution. For example, a company that notifies vendors about correct invoice formats often sees a 20% drop in exception rates. Clear communication and automation together reduce errors and keep the workflow on track.

Preventing and Detecting Fraud in AP

Fraud remains a persistent threat in any accounts payable workflow process. Typical schemes involve invoice manipulation, false vendor creation, or unauthorized payment approvals.

Technology plays a crucial role in detection. AI-based anomaly detection, such as that described in FinRobot: AI in ERP Systems, flags unusual payment patterns or suspicious vendor activity. These controls, combined with strong audit trails, make it harder for fraud to go undetected.

Regular reviews, dual approvals, and up-to-date vendor records are practical defenses. Teams must stay vigilant as fraud tactics evolve.

Managing High Invoice Volumes and Scaling AP

During periods of rapid growth or seasonal spikes, the accounts payable workflow process can become overloaded. High volumes challenge even the most efficient teams.

Batch processing, workload balancing, and leveraging cloud accounts payable solutions help organizations scale. Cloud platforms automate repetitive tasks, support remote work, and allow AP staff to focus on exceptions rather than data entry.

For firms with mass payouts, automation ensures deadlines are met and supplier satisfaction remains high. Outsourcing can supplement in-house resources, but clear process ownership is critical for success.

Ensuring Compliance with Local and International Regulations

Compliance is a growing concern for the accounts payable workflow process, particularly with shifting tax laws and e-invoicing mandates. Businesses operating internationally must adapt to evolving rules like the EU’s VAT changes.

Staying compliant involves:

- Keeping up with regulatory updates

- Maintaining detailed audit trails

- Implementing controls for tax and invoice validation

Automated systems can flag non-compliant invoices before payment. Training AP teams on local requirements and using compliance checklists further reduces risk. A proactive approach helps avoid penalties and builds trust with authorities.

Measuring and Improving AP Performance

Continuous improvement is vital for a healthy accounts payable workflow process. Key performance indicators (KPIs) such as Days Payable Outstanding (DPO), invoice cycle time, and error rates offer insights into process efficiency.

Teams should:

- Track and benchmark KPIs monthly

- Use dashboards to spot bottlenecks

- Audit processes for recurring issues

Data-driven reviews identify trends and inform process tweaks. For example, reducing invoice cycle time not only improves supplier relations but also frees up working capital for reinvestment.

As you’ve seen throughout this guide, mastering the accounts payable workflow is crucial for future proofing your business—especially as automation, compliance demands, and real time payments reshape the landscape in 2026. If you’re ready to simplify your processes, reduce risk, and explore solutions that fit both fiat and crypto transactions, we’re here to help. Let’s work together to build a secure, efficient AP system tailored to your needs.

Contact sales

and discover how Payoro can support your journey toward seamless accounts payable management.

Share article on

Cross Border QR Payment Guide: Your 2026 Success Blueprint

Unlock seamless global transactions with our cross border qr payment guide Learn strategies, compliance tips, and future trends...

The Essential Accounts Payable Workflow Guide for 2026

Master the accounts payable workflow in 2026 with this step by step guide covering automation compliance risk management...

The Expert Guide to AP and Payment Automation (2026)

Unlock the future of AP and payment automation with expert strategies, real world case studies, and actionable steps...

Automating Payments Guide: Streamline Your Finances in 2026

Automating payments in 2026 simplifies finances, reduces late fees, and boosts security. Discover expert strategies and tools to...